All Categories

Featured

Table of Contents

- – Premium Accredited Investor Growth Opportuniti...

- – Accredited Investor Investment Returns

- – Most Affordable Accredited Investor Investmen...

- – High-Quality Accredited Investor Real Estate ...

- – Efficient Accredited Investor Syndication Deals

- – Market-Leading Passive Income For Accredited...

- – Exclusive Accredited Investor Investment Net...

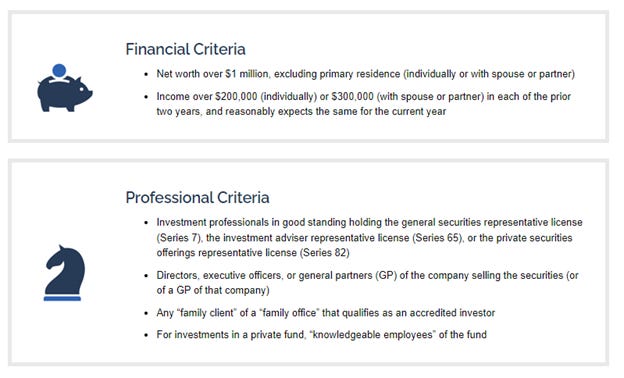

The laws for certified investors vary among jurisdictions. In the U.S, the meaning of a recognized investor is put forth by the SEC in Guideline 501 of Guideline D. To be a recognized financier, an individual must have a yearly revenue going beyond $200,000 ($300,000 for joint income) for the last two years with the expectation of making the same or a higher revenue in the current year.

This amount can not include a main residence., executive officers, or directors of a business that is releasing non listed protections.

Premium Accredited Investor Growth Opportunities for Wealth-Building Solutions

If an entity is composed of equity proprietors who are approved financiers, the entity itself is a certified investor. Nonetheless, an organization can not be created with the single purpose of acquiring certain safeties - accredited investor platforms. A person can qualify as an approved capitalist by demonstrating adequate education and learning or job experience in the economic market

Individuals who wish to be approved financiers don't put on the SEC for the designation. Rather, it is the obligation of the business providing a personal positioning to see to it that all of those approached are recognized capitalists. Individuals or parties that desire to be certified financiers can approach the issuer of the non listed securities.

Mean there is an individual whose income was $150,000 for the last 3 years. They reported a primary residence worth of $1 million (with a home loan of $200,000), an auto worth $100,000 (with a superior car loan of $50,000), a 401(k) account with $500,000, and a savings account with $450,000.

Internet worth is determined as properties minus liabilities. He or she's internet worth is exactly $1 million. This includes a calculation of their assets (apart from their main house) of $1,050,000 ($100,000 + $500,000 + $450,000) much less an automobile lending amounting to $50,000. Considering that they meet the total assets demand, they qualify to be an accredited capitalist.

Accredited Investor Investment Returns

There are a few less typical certifications, such as taking care of a count on with greater than $5 million in properties. Under government securities laws, just those who are approved financiers may join certain securities offerings. These might consist of shares in personal positionings, structured items, and exclusive equity or bush funds, to name a few.

The regulatory authorities wish to be specific that participants in these highly risky and complicated financial investments can fend for themselves and judge the threats in the absence of federal government defense. The certified financier regulations are made to safeguard possible capitalists with limited economic understanding from adventures and losses they may be ill equipped to withstand.

Approved financiers fulfill credentials and specialist criteria to access exclusive financial investment opportunities. Approved investors must meet income and internet well worth requirements, unlike non-accredited people, and can spend without restrictions.

Most Affordable Accredited Investor Investment Opportunities

Some vital adjustments made in 2020 by the SEC consist of:. This adjustment acknowledges that these entity types are commonly made use of for making financial investments.

These changes increase the recognized financier pool by around 64 million Americans. This broader access provides more possibilities for financiers, yet additionally increases potential dangers as less economically innovative, investors can take part.

One major advantage is the opportunity to invest in placements and hedge funds. These financial investment options are unique to recognized capitalists and institutions that certify as an accredited, per SEC regulations. Private positionings enable firms to safeguard funds without navigating the IPO treatment and regulative documentation needed for offerings. This offers certified investors the chance to invest in arising firms at a phase before they think about going public.

High-Quality Accredited Investor Real Estate Deals for Accredited Investors

They are deemed investments and are obtainable just, to certified clients. Along with recognized business, certified investors can pick to purchase start-ups and promising ventures. This supplies them tax returns and the chance to get in at an earlier phase and potentially gain rewards if the business prospers.

For financiers open to the risks entailed, backing start-ups can lead to gains (venture capital for accredited investors). Most of today's technology firms such as Facebook, Uber and Airbnb originated as early-stage startups supported by certified angel capitalists. Innovative capitalists have the chance to discover financial investment choices that may yield extra revenues than what public markets use

Efficient Accredited Investor Syndication Deals

Returns are not guaranteed, diversification and portfolio enhancement alternatives are broadened for financiers. By expanding their profiles via these increased investment methods recognized investors can improve their methods and possibly accomplish premium long-term returns with correct threat administration. Seasoned capitalists usually experience investment choices that may not be easily offered to the general financier.

Investment options and securities offered to accredited financiers usually entail greater dangers. Personal equity, venture resources and hedge funds frequently concentrate on investing in possessions that lug threat but can be sold off conveniently for the opportunity of better returns on those dangerous financial investments. Looking into before spending is vital these in scenarios.

Lock up durations stop investors from withdrawing funds for even more months and years on end. Financiers may have a hard time to properly value personal possessions.

Market-Leading Passive Income For Accredited Investors

This adjustment may expand recognized capitalist standing to a series of people. Updating the earnings and possession criteria for inflation to guarantee they reflect modifications as time progresses. The current limits have actually stayed fixed considering that 1982. Allowing partners in committed partnerships to incorporate their sources for common qualification as accredited financiers.

Allowing people with particular specialist certifications, such as Series 7 or CFA, to certify as certified financiers. Creating additional needs such as evidence of monetary proficiency or effectively completing a recognized financier examination.

On the various other hand, it might likewise result in seasoned investors thinking too much risks that might not be suitable for them. Existing recognized investors may encounter enhanced competitors for the finest financial investment opportunities if the swimming pool expands.

Exclusive Accredited Investor Investment Networks for Accredited Investors

Those that are currently taken into consideration recognized financiers need to remain upgraded on any kind of changes to the standards and regulations. Their qualification could be based on adjustments in the future. To preserve their condition as recognized financiers under a revised interpretation modifications might be essential in riches management techniques. Services seeking recognized financiers need to remain alert about these updates to guarantee they are drawing in the appropriate target market of capitalists.

Table of Contents

- – Premium Accredited Investor Growth Opportuniti...

- – Accredited Investor Investment Returns

- – Most Affordable Accredited Investor Investmen...

- – High-Quality Accredited Investor Real Estate ...

- – Efficient Accredited Investor Syndication Deals

- – Market-Leading Passive Income For Accredited...

- – Exclusive Accredited Investor Investment Net...

Latest Posts

Buy Houses For Back Taxes

Unpaid Property Taxes Near Me

Tax Defaulted Properties

More

Latest Posts

Buy Houses For Back Taxes

Unpaid Property Taxes Near Me

Tax Defaulted Properties