All Categories

Featured

Table of Contents

- – Esteemed Accredited Investor Platforms

- – Esteemed Accredited Investor Passive Income Pr...

- – Accredited Investor Real Estate Deals

- – All-In-One Accredited Investor Opportunities

- – Comprehensive Accredited Investor Real Estat...

- – Acclaimed Accredited Investor Investment Opp...

- – Accredited Investor Investment Opportunities

The regulations for certified financiers vary amongst jurisdictions. In the U.S, the definition of an approved investor is presented by the SEC in Regulation 501 of Guideline D. To be a certified investor, a person must have an annual income surpassing $200,000 ($300,000 for joint income) for the last two years with the expectation of earning the same or a higher revenue in the existing year.

This amount can not consist of a primary house., executive policemans, or directors of a business that is providing non listed safeties.

Esteemed Accredited Investor Platforms

Likewise, if an entity includes equity owners that are accredited investors, the entity itself is an accredited capitalist. However, an organization can not be formed with the sole function of acquiring particular safeties - high yield investment opportunities for accredited investors. A person can certify as an accredited financier by demonstrating sufficient education or work experience in the economic sector

Individuals who wish to be recognized investors do not put on the SEC for the designation. Instead, it is the responsibility of the firm providing an exclusive positioning to see to it that every one of those approached are accredited investors. People or parties that intend to be approved financiers can come close to the provider of the non listed protections.

As an example, mean there is a private whose income was $150,000 for the last three years. They reported a primary house worth of $1 million (with a mortgage of $200,000), an automobile worth $100,000 (with a superior funding of $50,000), a 401(k) account with $500,000, and a financial savings account with $450,000.

Total assets is calculated as possessions minus obligations. He or she's net well worth is exactly $1 million. This includes a calculation of their properties (various other than their primary home) of $1,050,000 ($100,000 + $500,000 + $450,000) much less an auto loan equaling $50,000. Considering that they fulfill the total assets requirement, they certify to be an accredited investor.

Esteemed Accredited Investor Passive Income Programs

There are a few less usual qualifications, such as managing a trust fund with greater than $5 million in possessions. Under government protections laws, just those that are certified capitalists might take part in particular safety and securities offerings. These might include shares in personal placements, structured products, and exclusive equity or hedge funds, to name a few.

The regulators intend to be specific that participants in these extremely risky and complex investments can fend for themselves and evaluate the dangers in the absence of federal government security. The accredited investor regulations are created to secure prospective financiers with limited financial expertise from high-risk endeavors and losses they may be ill geared up to hold up against.

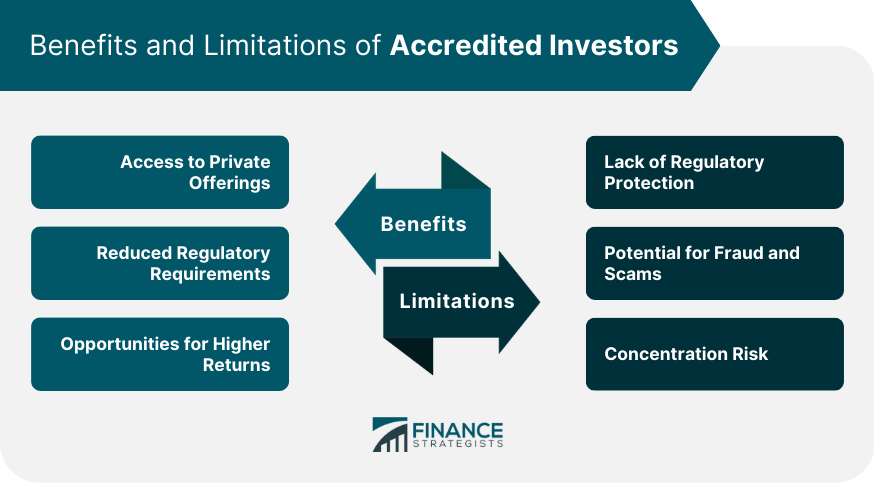

Approved financiers fulfill credentials and professional criteria to access special investment possibilities. Certified financiers should meet income and internet well worth demands, unlike non-accredited people, and can spend without limitations.

Accredited Investor Real Estate Deals

Some key adjustments made in 2020 by the SEC consist of:. This change acknowledges that these entity types are usually made use of for making financial investments.

These changes broaden the certified investor pool by roughly 64 million Americans. This broader access supplies a lot more chances for investors, yet also enhances possible risks as less monetarily sophisticated, financiers can participate.

These financial investment options are unique to accredited investors and establishments that certify as an accredited, per SEC guidelines. This offers accredited capitalists the chance to invest in arising firms at a phase before they think about going public.

All-In-One Accredited Investor Opportunities

They are considered as investments and come only, to qualified clients. In addition to known firms, qualified financiers can select to purchase startups and promising endeavors. This provides them tax returns and the possibility to go into at an earlier phase and potentially enjoy rewards if the business thrives.

Nevertheless, for investors available to the threats entailed, backing start-ups can lead to gains. A lot of today's tech companies such as Facebook, Uber and Airbnb originated as early-stage startups sustained by recognized angel financiers. Sophisticated capitalists have the chance to discover investment alternatives that might produce a lot more revenues than what public markets use

Comprehensive Accredited Investor Real Estate Deals

Returns are not assured, diversification and profile improvement options are broadened for capitalists. By diversifying their portfolios with these expanded investment avenues certified investors can improve their methods and potentially attain superior long-lasting returns with appropriate risk monitoring. Experienced financiers often come across investment alternatives that may not be quickly available to the basic capitalist.

Investment options and securities provided to certified investors usually include higher risks. For instance, exclusive equity, equity capital and hedge funds usually concentrate on purchasing possessions that bring risk but can be liquidated easily for the possibility of greater returns on those risky investments. Looking into prior to investing is important these in scenarios.

Secure periods stop capitalists from taking out funds for even more months and years on end. There is likewise much much less openness and regulative oversight of private funds compared to public markets. Financiers may battle to accurately value exclusive properties. When managing dangers accredited capitalists require to examine any type of personal investments and the fund supervisors involved.

Acclaimed Accredited Investor Investment Opportunities

This change might extend recognized capitalist standing to an array of individuals. Permitting partners in committed connections to combine their sources for common qualification as certified investors.

Enabling people with specific professional accreditations, such as Series 7 or CFA, to qualify as accredited capitalists. Creating extra demands such as proof of financial literacy or successfully completing a certified investor examination.

On the other hand, it might additionally result in skilled capitalists presuming too much dangers that might not be suitable for them. Existing certified financiers might deal with raised competitors for the finest financial investment possibilities if the swimming pool grows.

Accredited Investor Investment Opportunities

Those that are currently considered certified capitalists should remain updated on any kind of modifications to the requirements and regulations. Businesses seeking accredited financiers need to remain vigilant concerning these updates to guarantee they are attracting the best target market of capitalists.

Table of Contents

- – Esteemed Accredited Investor Platforms

- – Esteemed Accredited Investor Passive Income Pr...

- – Accredited Investor Real Estate Deals

- – All-In-One Accredited Investor Opportunities

- – Comprehensive Accredited Investor Real Estat...

- – Acclaimed Accredited Investor Investment Opp...

- – Accredited Investor Investment Opportunities

Latest Posts

Buy Houses For Back Taxes

Unpaid Property Taxes Near Me

Tax Defaulted Properties

More

Latest Posts

Buy Houses For Back Taxes

Unpaid Property Taxes Near Me

Tax Defaulted Properties